Why eEasyTax Accounts Payable Services is a Better Option (than Employing an In-House Officer)

It is the purpose of this section of the eEasyTax website to demonstrate that it is a better option for the employers in Australia to utilize eEasyTax Accounts Payable Services (eEasyTax APS) instead of employing an Accounts Payable Officer performing accounts payable functions for their organization.

Basically, eEasyTax APS will:

- enable wages savings up to 50%;

- eliminate the need to arrange temporary replacement during leave of absences of the in-house officer; and

- achieve probably better staff performance in yielding the desired results.

How Does eEasyTax Accounts Payable Services Work

Before providing details on how eEasyTax APS works, we would like to introduce our Organisation Chart for eEasyTax APS for the next 2 years

As shown, we are planning to assist the accounts payable services functions of a maximum of 4 companies from 2024 to 2026.

A member of the Management Team has been assigned as the Manager of the eEasyTax APS responsible for the overall day to day management, including training and supervision of the eEasyTax APS Team Members.

For every company in Australia, an APS Team Member will be assigned to specifically look after the accounts payable functions of that company. In addition, for every 2 companies, eEasyTax APS will appoint a Liaison Officer and a Supervisor to assist the APS Team Member.

It is the duty of the Liaison Officer to assume the role of bridging communications between the company and eEasyTax APS. Then, it is the responsibility of the Supervisor to ensure the proper performance of the APS Team Member and to act as replacement of the Team Member, if required.

The Liaison Officer, based in the Philippines, will be working on Australian working hours and officers of the Australian company are free to contact the Liaison Officer by email, instant messenger or by phone.

From a communication point of view, any officers of the company can contact eEasyTax APS Team Members, the Supervisor, the Liaison Officer, and the APS Manager via email, instant messenger or mobile phone on a 24/7 basis.

This way, any emergency instructions, including calculations of urgent payments to goods & services providers can be attended to in the shortest period, normally within 2 to 3 hours, given the fact that APS Team Members work full time and most payments calculations are up to date 24 hours after receipt of payment details.

At present, eEasyTax APS uses Xero to perform its accounts payable functions. However, eEasyTax APS can specifically train its staff to utilize any special accounts payable packages the Australian employer desires us to use.

Monetary Savings

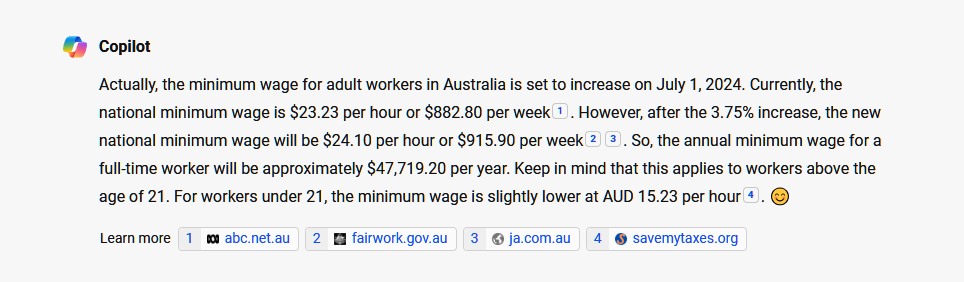

From a monetary saving point of view, the minimum wage for an adult worker in Australia in Feb 2024 is $45,905 per annum, as confirmed by the following snipshot:

According to the National Award for Payroll Officer, employers must also pay:

- Superannuation– 5% of salary

- Annual Leave– 4 weeks per year

- Annual Leave Holiday Loading– 21.5% of holiday pay

- Carer’s Leave– 10 days per year

- Long Service Leave– per Award

- Worker’s Compensation Premium – around 2% of salary

The practical implication will mean that the total amount to employ an Accounts Payable Officer will be at least 1.2259 times of the basic salary, even if we ignore the Long Service Leave and the Worker’s Compensation premium.

Copilot, an AI program, advised that the average salary for a Accounts Payable Officer in Australia is $72,118 per annum; please click here for a copy of Copilot’s comments. By the time when we add the amounts for the first 4 items above, the employer will be looking at an annual outlay of $88,409. This amount is excluding wages payable to replacement staff during the absence of the payroll officer on leave. If this element is included, we will be looking at over $ 90,000 per annum.

Replacement while Accounts Payable Officer is On Leave

If the employers opt to use our services, they will be paying around $45,000 per annum and there is no need to organize replacement for the in-house Accounts Payable Officer during his absences on leave.

We know by law that any full-time worker in Australia is allowed 4 weeks Annual Leave and 10 days Carer’s Leave per year. These are their statutory entitlements. Normally, employers will have to organise replacement staff to perform the accounts payable duties when the in-house officer is on leave. The advantage of using eEasyTax APS is that because eEasyTax APS employs a hierarchy of staff in APS Team Member, Supervisor & Liaison Officer, to perform the duties, there will be no need to worry about getting a replacement. This arrangement not only simplifies the procedure but also enables better performance in minimizing possible errors created by the temporary replacement.

The Myth for the Need in Employing In-house Employees

One of the advantages in employing in-house Accounts Payable Officer is that it enables the employer to give instructions to the Accounts Payable Officer face to face, thus minimizing any misunderstanding in communication. To an extent, this is the most important advantage in employing a local member.

However, employers must take into consideration of the following factors, in considering using eEasyTax APS as an alternative solution:

- eEasyTax APS’s Management Team is consisted of 3 senior accountants with hands-on experience in running businesses in both the industry and the profession. The eEasyTax APS Manager is an experienced accountant who speaks clear & fluent English. Our Liaison Officers & Supervisor are trained accounts payable personnel with effective English skills. We expect no communication gaps both in terms of accounts payable concepts & practices, and the English language skills.

- Covid-19 had prevented employees from returning to work and opened the door to allow workers performing duties on a remote basis; this alternative arrangement has introduced a new element in the corporate working practices in that more and more organisations are beginning to accept remote workers as a corporate norm. Indeed, at the end of the day, it is the finished product that counts, and not necessarily the need to give verbal instructions to a local member, face to face, which matters.

- During the past year, almost everyone in the corporate world is talking about AI and the likely adverse impacts in the future history of mankind. There are so many prophecies about many of the office tasks being replaced in the AI era and we, as managers, must prepare ourselves to face the challenges ahead. One of the most important considerations is the fact that, we must be prepared to adopt changes, including critically looking at reducing our expenditure in any possible way. In this regard, a saving of $45,000 a year on the salary of an Accounts Payable Officer, is not an amount to be sniffed at by any business operation.

Conclusions

- eEasyTax APS will reduce the amount of wages and related payments by 50 percent, or around $45,000 a year.

- eEasyTax APS will also eliminate the need for staff replacement during the local member’s absences on leave.

- eEasyTax APS is consisted of experienced payroll personnel with good communication skills.

- eEasyTax APS will enable at least comparable, if not a more superior, outcome because the way the tasks are performed.

- Covid-19 had altered the corporate working culture in that more and more business entities are adopting remote work as the norm.

- The AI Era has arrived, and all managers must be prepared to adopt changes.

- An absolute saving of $45,000 a year must be carefully considered and any responsible manager in any organization will be failing in his duties, if he fails to adequately consider the opportunity offered.

- Please click on the following button to open a dialogue with us in exploring eEasyTax APS further.